When candidates or selectors look at filling a new position, within or outside an organization, both entities need to carry out a “Context-Fit Assessment” (CFA). This is in addition to other standard parameters used to ensure the probability of success of the selected candidate, in the new role. Generally, when it comes to selecting leaders, we feel all challenges are manageable irrespective of the environment in which they occur. Yet we do not expect a great footballer to excel at cricket. Successful leaders choose their playing fields and strategize accordingly.

CFA in Cricket – An expert opinion on ‘Cricket Pitch’ conditions states that the nature of the pitch plays an important role in the actual outcome of the game. It has a significant influence on team selection and other aspects of the game. Also, when the pitch deteriorates as a match progresses, it has a considerable impact on the success or failure of a team’s bowling or batting efforts.

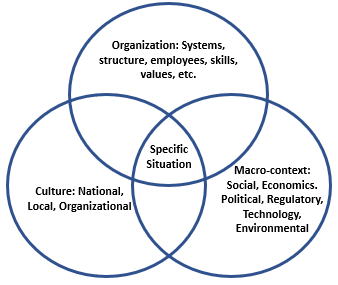

Selection Assessments made by individuals or hirers mostly cover job competencies, culture, and compensation fits. Very few consider “Context-Fit” which is generally done by intuition or asking for references. CFA increases with importance for higher positions. A deep-dive CFA with focused parameters is crucial for leadership selection.

An appreciation of broad parameters for CFA: Context in the broad sense would include the standard PESTEL framework parameters used for environmental scanning and macro-analysis. However, selectors or candidates may want to pick lower-level nuances (parameters) that affect specific position performance. These could be:

- Personal: Culture related to personal approaches to time, authority, individualism, communication styles, etc. This is in addition to an orientation towards task, outcome, stability, and teamwork, etc.

- Corporate: Management culture and characteristics.

- Government and Politics: The local environmental formal and informal practices vis-a-vis regulation, law, and order, the justice system, system of bureaucracy, etc.

Position-centric parameters are chosen from the above pointers which enable a better CFA overview.

Why does CFA matter for leader selection?

In the corporate context to be successful as a leader, a fair amount of knowledge and experience in the specific environment (context) is a must. The context fit may not be 100% but it should be a close match. Example: Two world-renowned multinational organizations, that provided a software product to large enterprises, formed a joint venture and came out with a similar product to address the needs of the MSME market. Both selected their best people to lead the JV. The JV failed and closed down in 2 years. Analysis showed that the selected leaders failed due to a lack of context-fit. The leaders, though loyal and highly experienced in managing steady-state and highly predictable environments, were not familiar with start-up unpredictability which required a high level of real-time adaptation to internal and external changes. CFA-Gap: Lack of experience in start-up ventures.

Context Matching in Leader Selection

While CFA can be discussed in broad and theoretical terms, a more practical “Feet on the Ground” approach would need to take into consideration position-specific external and internal business environments. These would include (1) External environment – the competitive landscape, changes in industry dynamics, disruptive technology or business models, and the degree of volatility or stability. Other influencing factors would be the economy, government policies, political influences, regulatory compliance, and enforcement, etc. (2) Internal environment would include the relevant strategies (finance, product, marketing, operations, technology, etc.), organizational structure, systems in operation, employees and capability levels. On the softer side, it would include the style of functioning, power centers, and departmental dominance, etc.

Leader Competencies and Attributes vis-a-vis Context-Fit

The selection of relevant parameters to do a CFA is crucial for appropriate candidate selection. A good start would be to look at the various change management models. These models cover a wide range of parameters to ascertain success from an “As-Is” to a “To-Be” state in different scenarios. Some models are Lewin’s change management model; ADKAR model; Kotter’s 8-step change model; Kubler-Ross change curve; McKinsey 7s model: PDCA process; Bridges Transition Model; etc.

A Representative Case

An executive, Raman (NRI), managing a supply chain of a multinational subsidiary wanted to come back to India for personal reasons. He applied and was selected for the position of VP (Supply Chain) by a medium-sized family-owned firm TNX, in his native country. The owners were looking for a talented and experienced person to upgrade their supply-chain management (SCM) systems. They felt Raman was the right choice. Raman felt he was lucky to get such an opportunity close to his hometown. After a few interviews and reference checks on both sides, the contract was signed.

On taking over, Raman found that the SCM systems in TNX were mostly manual with patches of standalone software packages being used. At the same time, the SCM team was not tech-savvy and the age group was between 45-50. He was struggling to make the changes and often got frustrated. On the other hand, the TNX owners felt that they were sanctioning budgets to purchase new platforms and conduct training, but nothing was moving. They felt frustrated too. In the meantime, a study for introducing the new SCM platform exposed some serious anomalies in stock levels. These problems led to a free-for-all within TNX causing chaos. Raman finally left in 2 years and the owners were crestfallen after seeing much investment going down the drain.

CFA-Gap: Neither Raman nor the TNX owners carried out a context assessment to match expectations with respect to the availability of resources – the parameters to be considered in effecting a change. The owners thought an experienced leader with appropriate investment was enough. Raman on the other hand felt that implementation of systems with a bit of customization supported by appropriate training of staff would do the trick.

Conclusion

The case shared brings out issues related to both the selector and candidate. Numerous examples of successes and failures surround us – these happen at all levels, the board included. With some conscientious observation, it is possible to hone our CFA skills. Even if CFA is done, sometimes there are cases where the mismatch is known but the mitigation possibilities were misjudged. A greater understanding of knowing what you’re getting into or putting other people into will help to increase the probability of success.

Finally: This discussion would not be complete if it did not cover some of the possible motives behind role selection – by the leader himself or those that select him. Some motives:

- The leader chooses personal role transition: New challenges and enhanced experience, location for better comforts and family life, compensation and better career prospects, internal organizational friction due to different reasons, or just a change of scene. For all cases, the mitigation of risks to rewards must be carefully assessed in a realistic and objective manner. Another point often not considered is the matching of a leader’s and selector’s motives.

- Selectors Choice: To fill a gap in the organization, to solve a specific problem in the organization, to bring in fresh ideas, to raise the level of the organization by introducing best practices from candidate’s past experience, to bring in more business and partners from past connects, or to enhance the brand of the organization because of the credibility of the new incumbent.

Weighing the pros and cons in taking up a new role together with the assessment of risks and possible mitigations is important for success. These judgment calls can be finetuned by improving CFA capabilities over time.